Financial advisors help manage money today to prepare for the future

Searching for a financial advisor can be a daunting task. With dozens of certifications that can appear as mysterious letters after advisors’ names, it’s hard to know what designation is most helpful or most important.

“Some certifications are like a weekend of self-study,” says Andrew Head, director of the Center for Financial Success at Western Kentucky University. “Some advisors are like glorified salespeople, selling products with high commissions.”

Head says the certified financial planner (CFP) is the gold standard of financial planning certifications. By law a CFP must serve clients in a fiduciary manner—in other words, to always put the client’s interests first. Other certifications signify different levels of training or knowledge, sometimes with a focus on a certain area of financial planning.

“What can make one financial planner different from another is how they are compensated,” Head says.

He says it’s important to look at the compensation structure when considering an advisor—does he or she have an incentive, such as a commission, to sell certain services? The consumer should look for disclosure of conflicts of interest, and the advisor should be able to explain to a client how he or she manages them.

A consumer seeking a financial advisor can verify credentials and learn about a certification through checking with the certifying organization. Because you’re hiring someone to work for you, the common wisdom is to meet and talk with several financial advisors before choosing one.

Larry Bowen first learned about finances from his grandfather. Those lessons turned into a career for Bowen. Photo: Austin Tedder

Forming a partnership

“You have to become a partner with the client,” says Larry Bowen, consumer-member of Taylor County RECC, a financial advisor with the Edward Jones office in Campbellsville. “To take care of the client’s needs should be the only motivation. You’re with them through sickness and health.”

Some clients have been with Bowen through his full 21 years with Edward Jones, he says.

“This is a relationship-driven business,” says Rob Roar, a Grayson RECC consumer-member who owns RC Wealth Management in Grayson with business partner Jayson Capling. “I tell clients coming through the door, ‘If we’re going to work together, we’re forming a partnership, because you’re trusting me with your livelihood.’”

Roar and Capling work with clients to create “a road map” for reaching their goals. Their company partners with LPL, one of the largest brokerage firms in the U.S.

Short-term panic vs. long-term plans

Sometimes that partnership between financial advisor and client means talking clients through panic induced by the financial market and what they see on television or read in the news.

“A common mistake is not taking a long-term view of investing,” Roar says. “People get caught up in the news. You don’t want to be a trader. You want to be an investor.”

Chase Caudill of AppaFinancial in Paintsville helps clients see past the emotional reactions to a fluctuating market.

“One of the things I see regularly is people letting their emotions control their actions, especially with money,” says Caudill. “When the market is having swings, people will panic. A lot of people tend to buy high and sell low because of their emotions. A financial advisor can help.”

Caudill, who founded AppaFinancial in 2017 and has been a CFP since 2013, says he helps clients grow their portfolios over the long run. “I do a lot of retirement planning for people, advising how to save and invest their funds so they can retire one day. I also do a lot with people in their 20s and 30s who have money in 401(k) plans they want me to manage.”

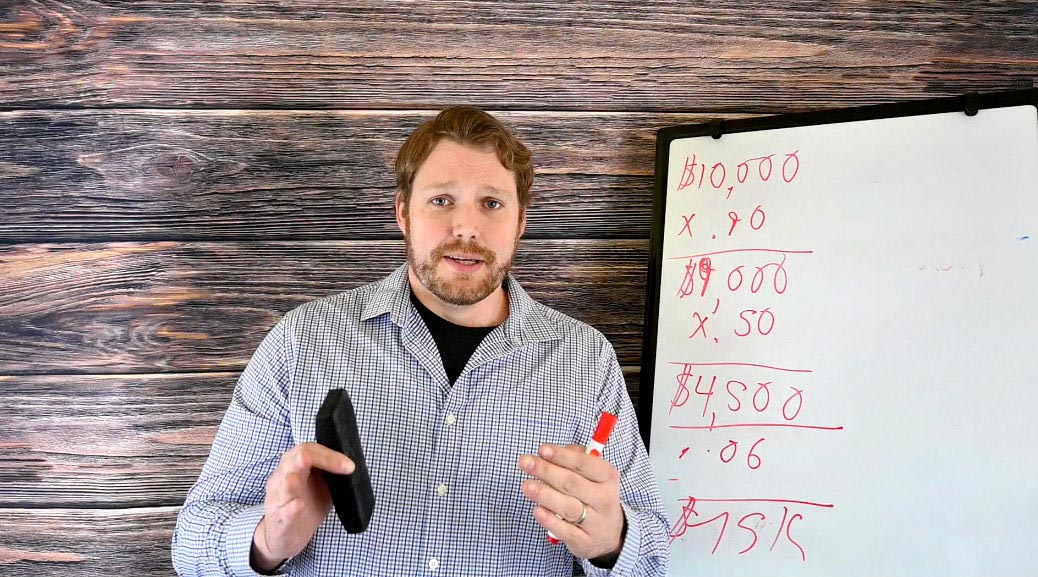

Some younger clients will cash out their 401(k) plan to pay off credit card debt, Caudill says, not realizing the big loss they’re taking because of tax consequences. “If you start in your 20s saving 10% to 15% of your gross income—and if you’ve got a company matching, you only need 5% to reach that 10%—with compounding interest you can retire with seven-figure wealth.”

Clients often bring the concern to Bowen that they might outlive their money: “We want to manage the account so that the money outlives them.”

Bowen says advising clients on how to invest and plan for their financial future comes with challenges, but it can also be rewarding.

“It’s always difficult, but you acquire skills and tools to perform at a high level. It’s constant work on expanding knowledge and improving those skills,” he says.

Different paths to the same profession

Larry Bowen, Edward Jones, Campbellsville

“My grandfather taught me about investments,” says Larry Bowen, consumer-member of Taylor County RECC. Bowen has been a financial advisor with Edward Jones for 21 years. His grandfather’s lessons compelled him to enter the world of finance.

Bowen earned a degree in business administration and a graduate degree in banking. In 1990, he became a bank loan officer with the aim of becoming a financial advisor. The first two or three years at Edward Jones, he says, requires intensive training, and during that time he prepared for and passed the rigorous Series 7 exam, obtaining his federal license for selling securities.

Rob Roar, RC Wealth Management, Grayson

Rob Roar, a consumer-member of Grayson RECC, took an avid interest in the stock market as a young man. As a teenager, he’d send away for prospectuses from major corporations, and thick manilla envelopes would arrive in the mail. He’d pore over them.

“My mother would say, ‘What in the world are you doing?’” he recalls. He got his business administration degree from the University of Kentucky.

“My first job was working for a forensic accountant, a super auditor looking for white collar crime,” says Roar. “That was almost three years hunting through numbers.” In 2005, he went to work for A.G. Edwards, which had a rigorous training program, with a broad training in finances and prepared him for the federal Series 7 exam, which licensed him to sell securities.

Chase Caudill, AppaFinancial, Painstville

Chase Caudill got hooked on the world of finance during his first corporate finance class in college. His entry job in finance was as a bank teller at a community bank, and later was promoted into the bank’s trust department, where he managed client investments.

Caudiil studied and received the federal Series 7 licensing to sell securities. Soon he headed the bank’s wealth management department while continuing his education, becoming a certified financial planner in 2013 and founding his own firm in 2017.

Caudill’s Facebook videos explain all kinds of financial matters, from credit cards to protecting rental property.

Personal Finances on the Military Front

Regina Harris is an accredited financial counselor on assignment at Fort Knox. “Mostly, I work with the military,” she says. “I do individual financial counseling. I brief people—that’s a military word—I lecture military personnel on finances.”

Harris got her credential from the Association for Financial Counseling & Planning Education, an organization that has a rigorous training and testing program to certify financial counselors.

“The military has a new retirement system,” says Harris, “so we’re telling personnel about that.”

A lot of her work is done one-on-one. People often come to her seeking specific advice, such as for buying a car. “I ask them, do you know how much you make? Do you have a budget? Otherwise, they won’t know how much they make and where it’s going,” says Harris. “We often times have to write out a budget, then we can talk about the issue.”

She advises people wanting to purchase a car to save a lot of money first. “Then buy a car for the lowest term. The more money up front, the lower the interest rate you can get.”

Credit is another hot topic, she says. “I have to explain to them that you don’t have to get credit. I personally don’t use a credit card. There’s no way to build credit without going into debt.”

She counsels people that if they want to build credit to do it carefully. “I recommend they get a secure credit card,” she says. “You make a savings account at a bank. The bank issues a credit card and reports it like a regular credit card.” That card is linked to the savings account and the user can’t spend more than what’s in the account.

“People don’t save enough money,” she says. “The U.S. has the lowest savings rate in the world of developed countries. At least have an emergency fund.” An emergency fund should cover at least six months of expenses or more. “I tell young people to hold onto $1,000 for emergencies, but more, if you make more.”

“Savings and getting out of debt, those are the biggest things,” Harris says. “I work a budget to show them how they can build savings while they get out of debt.”